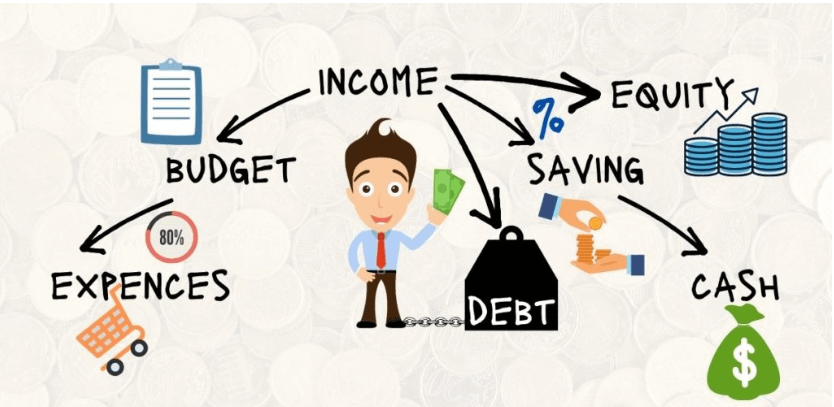

Ways Boost Financial Awareness – In today’s fast-paced world, managing your money effectively is more crucial than ever. From daily expenses to long-term goals like saving for a home, retirement, or your children’s education, every financial decision we make shapes our future. Yet, for many, understanding personal finance can feel like navigating a complex maze, leading to stress, missed opportunities, and sometimes, costly mistakes.

This is where financial awareness comes in. It’s not just about earning money; it’s about deeply understanding where your money comes from, where it goes, and how it can grow. It’s about being in control, making informed choices, and building a secure financial foundation for yourself and your loved ones. If you’ve ever felt overwhelmed by your finances or simply want to elevate your money management skills, you’re in the right place. This article will explore practical and actionable ways to significantly boost your financial awareness, empowering you to achieve your economic aspirations.

Start Small

If you’re already on a tight expense, storing anything can seem impossible. However, even if it saves a few bucks every now and then, it counts as progress and can help build up the habit of saving.

“Breaking large to-do into smaller make money goals feel much more can be done,” says Mary Wisniewski, Bankrate editor of Banking and fintech reporter features. “Currently, there are several mobile apps that can help you out, also-digit, Dobot, and Qapital among them. “

Fund your emergency savings.

The foundation of a solid financial plan is building and maintaining an emergency fund. This designated savings account can be a lifesaver when unexpected expenses come your way, which, unfortunately, will happen at some point. By being prepared for the unexpected, you are putting yourself in a much better and less stressful situation.

Open a high-yield savings account.

You’ve probably heard it before, but we’re gonna say it again: Make your money work for you.

One of the easiest, most risk-free ways to do this is opening a high-yield savings account. These accounts essentially pay you to store your money.

The longer your money sits, the more it grows. This method requires no heavy lifting on your end, just regular contributions so that your money can continue to grow.

Re-evaluate your spending money.

Many have changed in the past year as a result of a coronary viral pandemic, and there is a good chance that it impacts your budget in some way. If you haven’t revisited your budget, now may be the time.

Every time you go through a serious life change, you should take a fresh look at your budget as it will likely need to adapt to your new way of life.

In today’s world, it may mean you work from home, which could mean you spend less on transport and more on food – which needs to be reflected in your budget. The same goes for if you are one of the millions of Americans who find themselves recently idle.

Keeping your budget up to date and adapting to your current circumstances is the key to your financial success.

Start investing now.

If you are new to investing, one of the most important things that you need to know is that a diversified portfolio is very important.

Do not put all your eggs in one basket; Instead, spread your money at various stocks to keep the risk low.

A good place to start is with the S&P Index Fund 500, which offers stocks at the top 500 companies in America. Yes, this can be volatile and lose value; However, on average, investors get 10 percent of the time or a cash dividend of about 2 percent a year.

Plan for retirement

Retirement may seem like light-years away when you’re young, but it’ll creep up on you sooner than you think. You want to be financially prepared for when that day does arrive.

There are a few ways you can plan for retirement, but some of the most popular plans include:

401(k): These retirement plans are offered by employers and typically come with a match. Be sure you’re maxing out the match to get the full benefit.

Traditional IRA: A traditional IRA allows you to contribute pretax dollars, which means that any contributions are not taxable income. These contributions grow tax-free until the account holder withdraws them at retirement.

Roth IRA: A Roth IRA is similar to a traditional IRA; however, the main difference is that contributions are made with after-tax money, meaning you’ve paid the taxes on the money already and won’t have to pay anything when you take it out for retirement.

Bottom line: Make retirement planning a priority now, so you can enjoy it when the time comes.

Take stock of your debts.

Coming up with a plan for tackling your debt shouldn’t be something you put off.

Depending on the type of debt you have, there are a few things you will want to consider. For instance, if you have multiple student loans, then refinancing may be an option to consider.

In general, there are three types of repayment strategies to consider:

- The debt snowball: An approach where you gradually pay your debts from the smallest amount to the largest. This method is encouraging because you can see the progress you’re making earlier on.

- The debt avalanche: This method is similar to the snowball, but instead orders debt by interest rate. You’ll prioritize paying off debt with the highest annual percentage rate (APR) before moving to the next, and so on.

- Debt consolidation: If you have various debts to repay and are finding it difficult to keep track of, you may want to consider debt consolidation. This method rolls your debts into one loan with a single interest rate.

- Bottom line: Having a plan will help you breathe a little easier knowing that you’ve taken the first step to tackling your debt.

Write down your financial goals.

If you think about your finances and don’t have a specific goal in mind, that’s a good sign that you should sit down and figure out what those are. By setting a goal, you will be able to come up with a more specific saving strategy.

Some common financial goals to consider:

- Retirement

- Emergency Savings

- College

- A mortgage

- Vacation

Your goals will likely range from short-term to long-term, and each typically requires a different savings strategy if you want to be an effective saver.

Digitize your finances

One of the easiest ways to keep track of your finances is by digitizing them. Apps like Mint make it super easy to keep track of everything in one place and as a result, make it a whole lot easier to create a budget by taking everything into account.

You can also set these apps up to alert you when you’re approaching your budget for a certain category or when you have an upcoming bill.

Conclusion

Boosting your financial awareness is not a one-time task but a continuous journey—a journey that empowers you with control, confidence, and clarity over your money. By consistently applying the strategies we’ve discussed, such as diligently tracking your spending, setting clear financial goals, educating yourself about investments, creating and sticking to a budget, and regularly reviewing your financial health, you transform passive money management into an active, strategic pursuit.

Embracing greater financial awareness allows you to make informed decisions that align with your aspirations, mitigate risks, and ultimately build a more secure and prosperous future. It’s about replacing financial anxiety with peace of mind and unlocking the potential for true financial freedom. Start today, stay committed, and watch as your understanding and control over your finances grow, paving the way for a more stable and fulfilling life.

FAQ: Ways to Boost Financial Awareness

1. What is financial awareness?

Financial awareness is the understanding and knowledge of financial management, including how to manage income, expenses, savings, and investments.

2. Why is it important to increase financial awareness?

Increasing financial awareness helps individuals make better financial decisions, avoid unnecessary debt, and plan for a more stable financial future.

3. What is the first step to improving financial awareness?

The first step is to track all income and expenses. This helps you understand your cash flow and identify areas where you can save.

4. How can I learn about financial management?

You can learn through various resources, such as personal finance books, online courses, seminars, and articles on financial websites.

5. Are there apps that can help in managing finances?

Yes, many apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you track expenses and manage your budget.

6. How often should I evaluate my finances?

It is advisable to evaluate your finances monthly to ensure you stay on track and adjust your budget as needed.

7. What is a budget, and why is it important?

A budget is a financial plan that outlines your income and expenses. It is important for helping you control spending and achieve financial goals.

8. How do I start investing?

Begin by understanding the different types of investments (stocks, bonds, mutual funds) and defining your investment goals. Consider consulting a financial advisor if needed.

9. What is an emergency fund, and how do I build it?

An emergency fund is savings set aside for unexpected situations. Ideally, it should cover 3-6 months of living expenses. Start by saving a small portion of your monthly income until you reach your target amount.

10. How can I avoid unnecessary debt?

To avoid debt, create a budget and stick to it. Avoid using credit cards for unnecessary purchases and make sure to pay bills on time.

By understanding and applying these principles, you can boost your financial awareness and make better financial decisions.